Car accidents are unexpected and often stressful events that can leave you feeling overwhelmed, particularly when it comes to dealing with insurance claims. Whether the accident is your fault or someone else’s, it’s important to know how to navigate the claims process to ensure that you’re properly compensated for any damages or injuries. Filing a car insurance claim doesn’t have to be a difficult task if you approach it systematically.

In this article, we’ll walk you through the step-by-step process of how to file a car insurance claim, from gathering necessary information to resolving your claim. By the end, you’ll have a clear understanding of how to manage a claim and what to expect during the process.

Step 1: Ensure Safety and Address Any Immediate Concerns

The first priority in any car accident is safety. If you’re involved in an accident, make sure that you, your passengers, and anyone else involved in the accident are safe. Here’s what you should do:

- Check for injuries: Make sure everyone is okay. If there are injuries, call emergency services immediately.

- Move to safety (if possible): If the vehicles are drivable, move them to a safe location off the road to avoid further accidents. If not, stay inside the car and turn on your hazard lights.

- Call the police: For serious accidents or if there’s a dispute over who’s at fault, it’s important to call the police. A police report will help document the accident and can serve as an official record for your insurance company.

Step 2: Gather Information from All Parties Involved

After ensuring everyone’s safety, gather important details from the other driver(s) and witnesses. Here’s a list of the key information you need to collect:

- Driver’s license numbers for all drivers involved.

- License plate numbers of all vehicles involved.

- Contact information (phone numbers, addresses) for everyone involved.

- Insurance information, including the name of the insurance company, policy number, and contact information for the insurer.

- Make, model, and year of the vehicles involved in the accident.

- Witness contact details: If there are witnesses to the accident, get their names and contact information as they might be asked to provide statements.

Additionally, it’s helpful to note any road conditions, weather conditions, and other relevant details (such as traffic lights being out or construction zones) that may have contributed to the accident. This will help your insurance company assess the situation more clearly.

Step 3: Document the Accident Scene

Documenting the scene of the accident is critical for the claims process. The more information you have, the easier it will be for your insurance company to evaluate your claim. Here’s how to document the accident:

- Take pictures of the vehicles: Capture images of all involved vehicles, focusing on the damage. If you have a smartphone, take multiple pictures from different angles to ensure all damage is clearly visible.

- Photograph the surroundings: Include shots of the accident site, traffic signs, signals, skid marks, or anything else that might provide context about what happened.

- Write down your version of the accident: If you can do so safely, jot down your thoughts while the details are still fresh in your mind. This can help you remember important facts that you might forget later.

- Get a copy of the police report: If the police respond to the scene, they will file a report that documents the accident. Request a copy of the police report, as it can be vital to your claim.

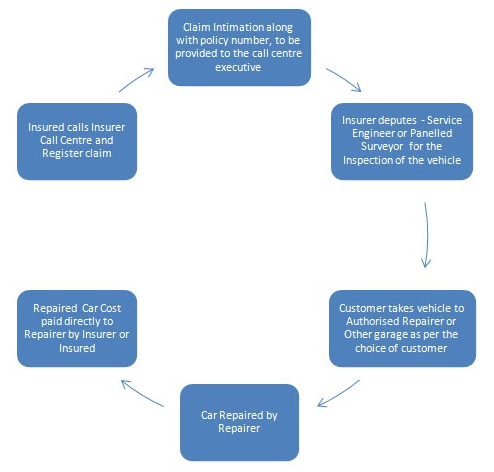

Step 4: Notify Your Insurance Company

As soon as possible after the accident, contact your insurance company to report the incident. Most insurers have 24/7 claim reporting lines or apps that allow you to file a claim online. It’s crucial to do this as soon as possible, as some insurance policies require claims to be reported within a certain time frame, such as within 24 to 48 hours.

When you call your insurer or file a claim online, be prepared to provide:

- Your policy number

- Details of the accident, including the date, time, location, and a description of what happened.

- Information about the other party, including their name, insurance information, and a description of the damage to their vehicle.

- Any police report number or reference number if applicable.

Be sure to stay calm and provide accurate information. The more complete and honest your report is, the more smoothly your claim will be processed.

Step 5: Meet with an Adjuster

After you file the claim, your insurance company will assign a claims adjuster to assess the damage and determine how much compensation you’re entitled to. The adjuster may contact you for a statement and will likely ask to inspect your vehicle or any damaged property.

- Schedule the inspection: If the damage is significant, an adjuster may come to your home, office, or a garage to inspect the damage in person. If the damage is minor, they might request photos of the damage.

- Review the damage: The adjuster will evaluate the damage to your car and determine whether it’s repairable or if the car is a total loss. They will also assess damages to other property or any bodily injuries you’ve sustained.

- Ask questions: If you’re unsure about anything during the inspection or claims process, don’t hesitate to ask the adjuster questions. They’re there to help you understand the process and your entitlements.

Step 6: Review the Insurance Company’s Offer

Once the adjuster completes their assessment, they’ll send you an offer based on their evaluation of the damage and the terms of your insurance policy. The offer will typically include:

- The total amount the insurer is willing to pay for the damages.

- Deductible details: Your policy may have a deductible, which is the amount you need to pay out-of-pocket before the insurance kicks in.

- Repair or replacement options: If your car is repairable, the insurer may provide a list of approved repair shops or send you a check to cover the repair costs. If your car is a total loss, the insurer will offer a settlement based on the car’s market value.

Carefully review the offer to ensure that it matches your expectations and the actual damage. If you disagree with the offer, you have the right to dispute it. You can provide additional documentation, such as repair estimates from independent shops, or negotiate a higher payout.

Step 7: Finalize the Claim and Settle the Damage

Once you’ve accepted the insurance company’s offer, the settlement process can begin. Here’s what to expect:

- Repair your car: If your car is repairable, take it to an approved repair shop. Your insurance company may work directly with the shop or reimburse you after you pay for the repairs.

- Total loss settlements: If your car is declared a total loss, the insurer will issue a payment based on the car’s market value. This payment may be used to purchase a new vehicle, or you may receive a check for the amount.

- Pay your deductible: If you have a deductible, you will need to pay it to the repair shop or the insurance company. Your insurer will cover the remaining costs, up to the policy limit.

At this point, your claim should be fully processed. You can expect to receive your settlement or payment in the form of a check or directly to the repair shop, depending on the terms of the policy.

Step 8: Follow Up and Track Your Premiums

Once the claim is settled, monitor your vehicle repairs and make sure everything is completed to your satisfaction. Additionally, keep an eye on your future insurance premiums. After filing a claim, your premiums may increase, particularly if you were at fault in the accident. Some insurance companies offer accident forgiveness or other programs that could minimize the increase.

Conclusion

Filing a car insurance claim may seem daunting, but understanding the steps and preparing ahead of time can make the process easier. From ensuring safety after an accident to gathering necessary information and working with an adjuster, knowing how to file a claim and what to expect can help you navigate through the situation with less stress. Always stay organized, document everything, and communicate clearly with your insurance provider to ensure a smooth and efficient claims process.