Getting into a serious car accident is stressful enough, but hearing your car has been “totaled” can make the situation even more confusing. What does it mean when a car is declared a total loss? How does car insurance cover a totaled vehicle? And how do you make sure you’re compensated fairly?

This comprehensive guide breaks down everything you need to know about how insurance works when your car is totaled, what to expect during the claims process, and how to maximize your settlement.

What Does It Mean When a Car Is Totaled?

A car is considered “totaled” or a total loss when the cost to repair the vehicle exceeds a certain percentage of its actual cash value (ACV). In other words, if fixing the car would cost more than it’s worth, your insurance company may decide it’s not worth repairing.

Each state and insurer has different thresholds, but the typical rule is:

- If repairs would cost 70% to 80% or more of the car’s value, it’s usually totaled.

- Some states use a Total Loss Formula (TLF): If repair costs plus salvage value exceed the vehicle’s value, it’s a total loss.

For example, if your car is worth $10,000 and the repairs would cost $8,000, your insurance company might declare it totaled, especially if it could only be sold for parts or salvage.

Types of Insurance That Cover a Totaled Vehicle

Whether your totaled vehicle is covered depends on what type of insurance you have and who was at fault.

1. Collision Coverage

- Covers damage to your car caused by a collision, regardless of who is at fault.

- If you crash into another vehicle or object and your car is totaled, collision insurance pays for the ACV of the vehicle, minus your deductible.

2. Comprehensive Coverage

- Covers damage to your vehicle caused by events other than a collision, such as theft, fire, flooding, hail, or vandalism.

- If your car is totaled due to one of these causes, comprehensive insurance pays the ACV, minus your deductible.

3. Liability Insurance

- If another driver is at fault and you don’t have collision coverage, their liability insurance should cover your vehicle’s damage.

- This may take longer, and you’ll need to deal with the at-fault driver’s insurer.

4. Uninsured/Underinsured Motorist Property Damage (UMPD)

- If your car is totaled by an uninsured or underinsured driver, this coverage (if you have it) may pay for your damages.

How Insurance Companies Determine the Value of a Totaled Car

If your vehicle is totaled, the insurance company won’t pay to fix it—they’ll offer a cash settlement instead. This amount is based on your car’s actual cash value (ACV) at the time of the accident.

What Is Actual Cash Value (ACV)?

ACV is your car’s market value before the accident. It accounts for:

- Age

- Mileage

- Condition

- Make and model

- Features (e.g., sunroof, navigation, leather seats)

- Local market demand

Insurers typically use third-party valuation tools like Kelley Blue Book, NADA, or CCC Intelligent Solutions to estimate the ACV. Then, they subtract your deductible from the final amount.

Example:

If your car’s ACV is $12,000 and your deductible is $1,000, your insurer will pay you $11,000.

What If You Still Owe Money on Your Car?

If your car is financed or leased, the insurance payout will go to the lender first. Here’s what can happen:

1. If the Insurance Payout Covers the Loan

- You’ll receive any remaining amount after the lender is paid off.

2. If the Loan Balance Is Higher Than the Payout

- You’re responsible for paying the difference—this is called being “upside down” on your loan.

3. GAP Insurance Can Help

Guaranteed Asset Protection (GAP) insurance covers the difference between what you owe and what your insurer pays if your car is totaled. It’s optional, but extremely useful for newer cars or long-term loans.

Steps to Take After Your Car Is Totaled

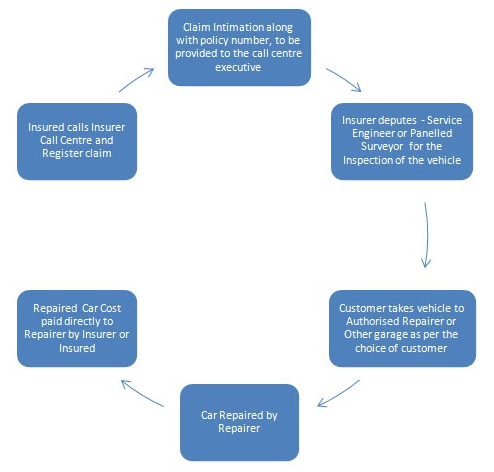

1. File a Claim Promptly

Contact your insurance company as soon as possible after the accident. Provide photos, police reports, and any relevant information.

2. Get the Damage Assessed

The insurance adjuster will inspect the vehicle or send you to a partner auto body shop. They’ll estimate repair costs and determine if the vehicle is a total loss.

3. Receive the Total Loss Offer

You’ll receive a settlement offer based on your car’s ACV. Review this carefully and make sure it matches your vehicle’s true market value.

4. Negotiate If Necessary

If you think the offer is too low, provide evidence like:

- Comparable vehicle listings in your area

- Service records and upgrades

- Receipts for recent repairs

5. Accept the Offer and Transfer the Title

If you accept the offer, you’ll sign the title over to the insurer and receive your payment. The car is usually sent to a salvage yard.

Can You Keep Your Totaled Car?

Yes — in some cases, you can choose to retain the salvage vehicle. The insurance company will subtract the salvage value from your settlement amount.

Keep in mind:

- You may need to apply for a salvage title, and later a rebuilt title if you plan to fix and drive the car again.

- Rebuilt vehicles may have reduced resale value and can be harder to insure.

What If You Disagree With the Total Loss Decision?

You can dispute the decision if:

- You believe the car is repairable.

- You think the ACV is too low.

Steps to take:

- Get an independent repair estimate.

- Provide comparable vehicle prices from local listings.

- Request a second opinion or appraisal.

If necessary, you can involve a lawyer or invoke the appraisal clause in your policy (if available), where each party hires an appraiser to agree on a value.

What’s Not Covered?

There are certain things a standard insurance policy may not cover when your vehicle is totaled:

- Personal items in the car (unless covered by homeowners or renters insurance)

- Aftermarket modifications not declared to your insurer

- Loss of value (diminished resale value due to accident history)

- Rental car coverage, unless you have it on your policy

Final Thoughts

Dealing with a totaled car can be overwhelming, but understanding how insurance coverage works helps you navigate the process with confidence. Whether you rely on collision or comprehensive coverage — or you’re working through another driver’s liability insurance — knowing your rights, the steps involved, and how car value is determined is essential.

Make sure you review your auto policy regularly, consider adding GAP insurance if you finance a new car, and be prepared to negotiate if you feel the insurance payout doesn’t match your car’s worth.

A totaled car doesn’t have to mean a financial loss — with the right approach, you can get back on the road with peace of mind and fair compensation.